Two Sigma describes itself as “a systematic investment manager, founded with the goal of applying cutting-edge technology to the data-rich world of finance.”

The SoHo, New York, based hedge fund was founded in 2001, by John Overdeck, David Siegel and Mark Pickard. Using AI, ML and distributed computing to invest, the fund has over $58 billion in AUM.

Overdeck, worth $5.5 billion, had good parental influences… his father was a senior mathematician at the NSA and his mother the director of the Computer Sciences Corporation. John went to Stanford, then on to Amazon and DE Shaw, before founding Two Sigma with David Siegel, former CTO at Tudor.

The firm has hired star researchers to the bench. For instance, this spring Two Sigma hired Mike Schuster, a 12 year senior research veteran on the Google Brain team, to head their AI expansion. He reports to CTO Alfred Spector, with whom he worked at Google, and the plan is to significantly expand the team.

Out of the company’s 1,300 people, over two thirds are involved in research and development.

Having the best in-house team is one thing – but Two Sigma goes way further. The website greets you with “SEEK: Calling all scientists, engineers, and academics. WE’RE HIRING”

And further still… as in crowdsourcing big data investment challenges.

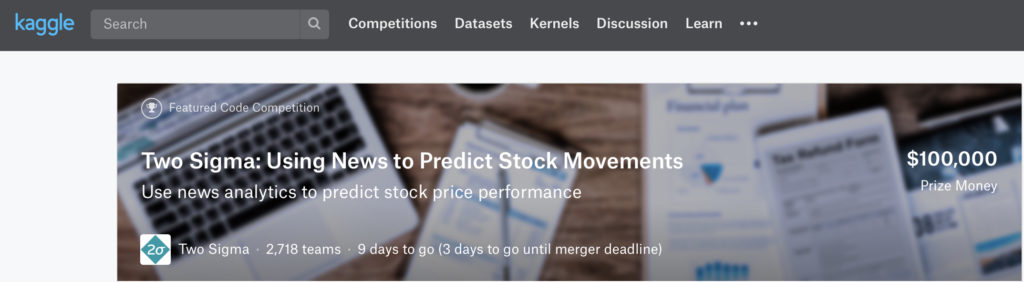

In 2017, the firm started running Kaggle data science competitions to code trading algorithms. It currently runs “Using News to Predict Stock Movements”, which with still nine days to go has already received 31,475 entries. The first prize for the comp is $25,000, then $20,000, $15,000, and $10,000 for places four through seven – AKA peanuts.

Kagglers, the data scientists on the platform, don’t build their algorithms for the money, they do it for the bragging rights. Importantly, Kaggle contests are won by people who are marginal to the domain of the challenge!!! In a few Hewlett-Packard AI competitions, none of the top three winners had any formal training in AI.

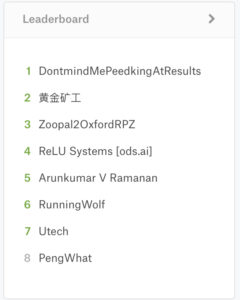

Which works out well for investment managers such as Two Sigma. The leader board for the challenge, as of today, is below:

The other two competitions run by Two Sigma on Kaggle, two years ago, involved financial modeling and rental listing inquiries.

Kaggle, the 8-year old online community of data scientists and machine learners, in turn, was acquired by Google in March 2017. Kaggle got its start by offering machine learning competitions and now also offers a public data platform, a cloud-based workbench for data science, and short form AI education.

When it comes to AI investing and the use of big data and machine learning to get an investment edge, Two Sigma grew from $2.5 billion to over $58 billion in ten years by focusing on human talent and big data crowdsourcing.

With the right team, you can, too.