Microsoft Research Finds Organizations Across Industries are “Embracing Tech Intensity As a Key Driver of Competitive Advantage”

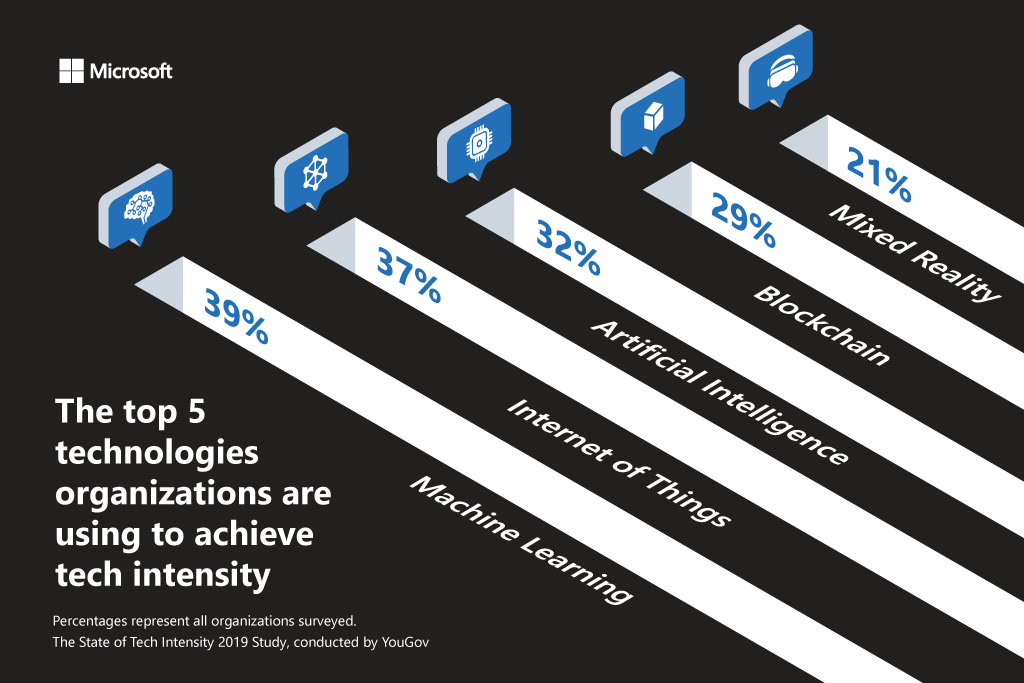

Microsoft polled 700 executives across industries for their “State of Tech Intensity 2019” study. “Tech Intensity” is defined as the applied use of a creative, entrepreneurial mindset to invent new digital capabilities using advanced technologies such as AI and IoT. Key findings from the study: Every company is becoming a tech company: 73% of companies …