About a year and a half ago, Jonathan Wilmot, Credit Suisse’s Chief Global Strategist and Head of Macro Research after over 30 years with the firm, took the data science department and started his own AI investment boutique, WilmotML – as in Machine Learning.

Aric Whitewood, CS’s Head of Data Science for seven years, left as well, along with his small core team of machine learning specialists. Whitewood got his PhD at UCL in Electronic Engineering and before Credit Suisse was in Thales Aerospace’s Systems Research Group.

In addition to the existing core team the duo also added a COO from KPMG and the LSE.

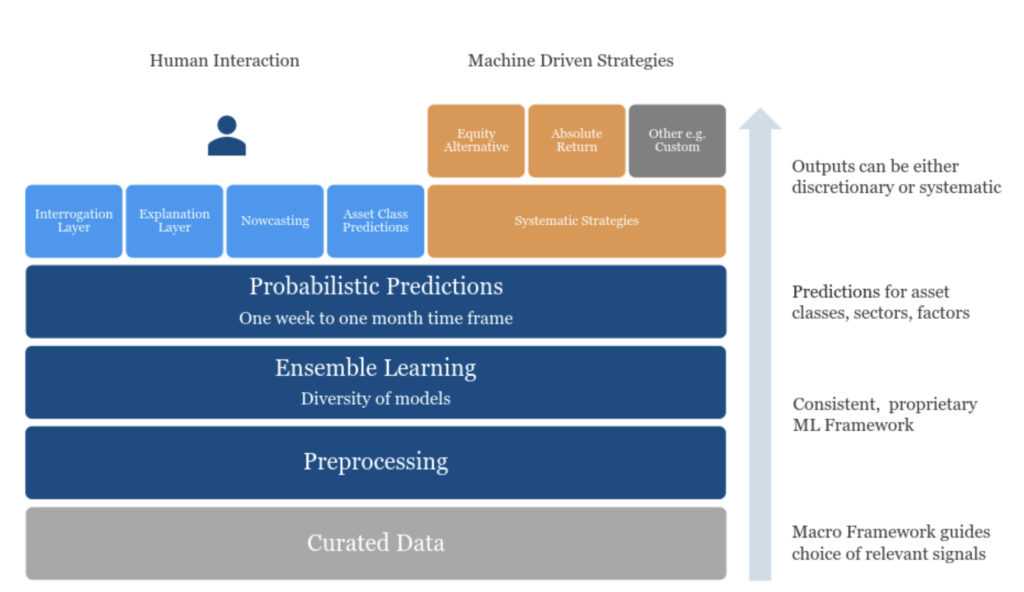

The pitch is simple: the best global macro research paired with advanced machine learning produces better investment results. The AI part of the equation focuses on

- noisy data

- curated data

- non-stationarity

- proprietary models

- small data sets

- transparency

To create a Global AI Allocator, aka, GAIA. GAIA is proprietary platform that creates predictions for asset classes, factors and currencies globally, implemented with highly liquid ETFs.

Some of the Secular Themes for WilmotML include: AI Everywhere, New Energy and Transport, Connected Cities, Smart Healthcare, and Geo-Political Reset.

Importantly, Wilmot recently said that the new competition will be Google, Alibaba and Tencent, i.e. the tech giants as the new fund managers in the upcoming AI machine age.

Exciting times.