Goldman Sachs agreed to buy Newport Beach based United Capital for $750 million in cash to build out a steady fee-based wealth management business and its Ayco Financial Counseling Capabilities, a mass affluent segment through Marcus and the Apple credit card, and digital financial planning tools to build new and enhance existing client segments.

In a press release, Goldman said it would expect the deal to close in Q3. UC has 220 wealth advisors that serve 22,000 clients with in total $25 billion across 90+ U.S. offices.

Notably, United Capital also operates FinLife CX, a digital platform that helps independent advisors grow their business and form stronger relationships with their clients. David Solomon, Chairman and CEO of GS, commented: “We have a leading wealth management franchise, driven by our preeminent Private Wealth Management and Ayco offerings, which will serve as a cornerstone of our business as we execute on our long-term strategy to offer clients solutions across the wealth spectrum. United Capital will help accelerate this strategy by broadening our reach.”

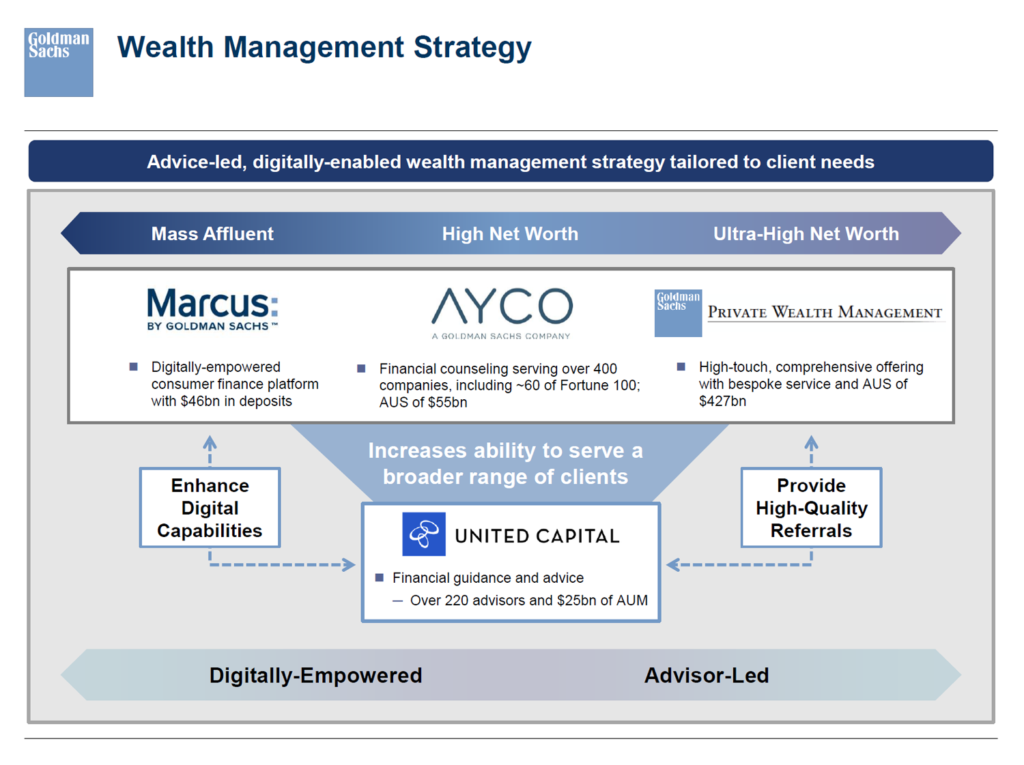

As shown in the slide above, GS expects UC to increase the firm’s ability to serve a broader range of clients, from mass affluent (digitally-empowered consumer finance platform Marcus), to HNW (Ayco financial counseling) to the Ultra-HNW segments (GS PWM, high-touch bespoke services).

Importantly, UC should help enhance digital capabilities and provide high-quality referrals as Goldman de-emphasizes the more volatile trading business.