Canada has always been a (quiet) leader of AI in its own right, with MILA, CIFAR, et al.

Manulife in Toronto owns John Hancock in Boston (combined AUM C$1 trillion+) and they have been playing with AI for insurance and investment management in a variety of ways.

Manulife – and under its John Hancock brand in the US – has established a global network of LOFTs in Boston, Toronto and Singapore, starting with a team liftout in 2016.

LOFT = Lab of Forward Thinking.

LOFT, an “internal incubator”, provides a digital platform for employees to collaborate and devise new technological solutions for the firm’s wealth, asset management, and insurance customers.

Two years ago Manulife’s LOFT started working with Boston-based AI startup indico data solutions, to create deep learning data tools to help analysts go through reading materials and financial information faster.

LOFT has been using indico’s platform to develop an artificial intelligence (AI) and Deep Learning tool to analyze unstructured financial data – the goal being to use DL to analyze data from news articles, analyst reports and other similar sources and present recommendations that could help investment researchers and portfolio managers make more informed decisions faster than before.

“indico helps us accelerate our use of Deep Learning to improve the decision-making capabilities of our analysts, portfolio managers and researchers,” commented EVP and CIO Greg Framke. The announcement followed Manulife LOFT’s collaboration with Nervana Systems to build the next generation of intelligent applications (Nervana, of course, was founded by a former Qualcomm exec with CIA funding, and then bought by Intel for $408 million last year, as we discussed recently in detail).

But let’s keep going.

John Hancock around the same time also bought San Francisco-based Guide Financial, a firm that applies “artificial intelligence to help investors make better planning decisions and build wealth.” Partnering with Inuit, Guide touches 19,000 financial institutions to aggregate a client’s accounts and financial information into a digital portal, where a FP engine analyzes the information and an algorithm helps advisors with cash flow and investment decisions. Advisors can message clients directly through the portal and set Guide Financial push notifications to keep clients informed and on track.

So far so good.

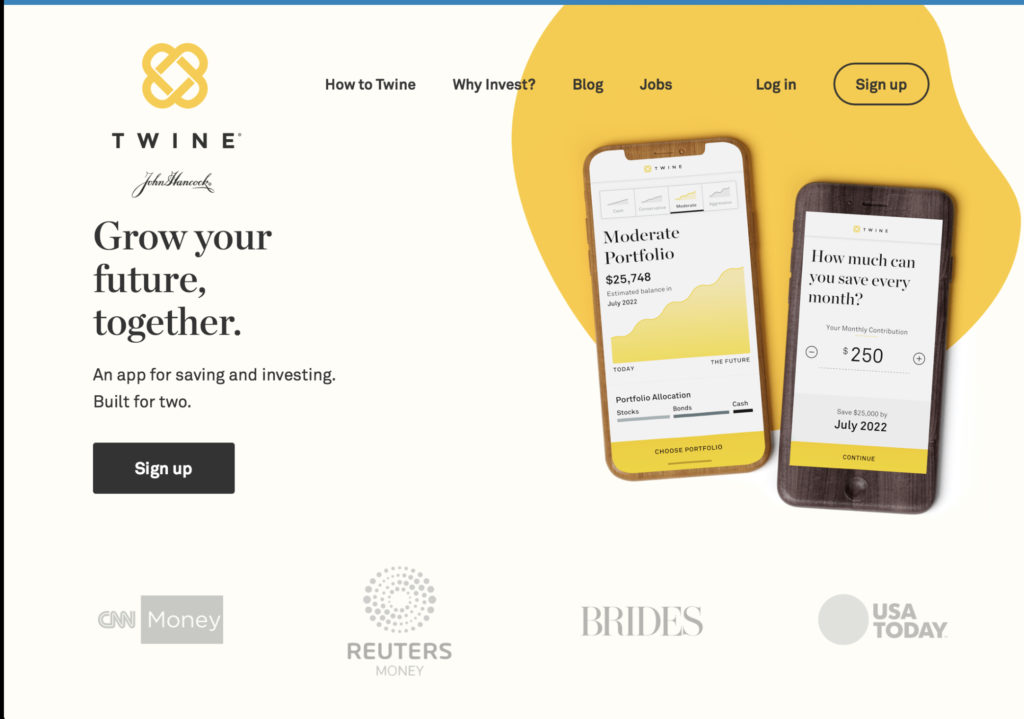

Guide’s Co-Founder and CEO, Uri Pomerantz, went on to create Twine John Hancock with and for the company, and last month was named the MD and Head of John Hancock Ventures in Silicon Valley.

Below is a podcast with Uri on how he used new technologies, Instagram et al to build his business and sell it to John Hancock.