Artificial Intelligence Industry Insights

Microsoft Research Finds Organizations Across Industries are “Embracing Tech Intensity As a Key Driver of Competitive Advantage”

McKinsey on Asian Asset Management – Five Disruptions Impacting Future Growth

Asset Management M&A Perspectives from Casey Quirk/Deloitte

Asset & Wealth Management Revolution: pwc identifies six game changers & four key trends for the decade ahead

Asset & Wealth Management Revolution: pwc identifies six game changers & four key trends for the decade ahead

pwc’s Asset Management research division in its latest snappy 32-page…

BCG Asset Management Outlook – Fees, Tech, EMs, ESG and Fewer Winners

BCG in an Asset Management outlook for the next ten…

KPMG: Women in Alternative Investments

KPMG’s sixth edition for Women in Alt Inv to leverage…

AQR Report: Can Machines „Learn“ Finance?

AQR‘s Portfolio Solution Group this week published a short but…

Embedding AI in Business: HBR Discussion with Accenture Chief Technology and Innovation Officer

Harvard Business Review this week did a 36-minute podcast with…

OECD Global AI Project: “Measuring the Digital Transformation – A Roadmap for the Future”

The OECD in March 2019 held the “Going Digital Summit”…

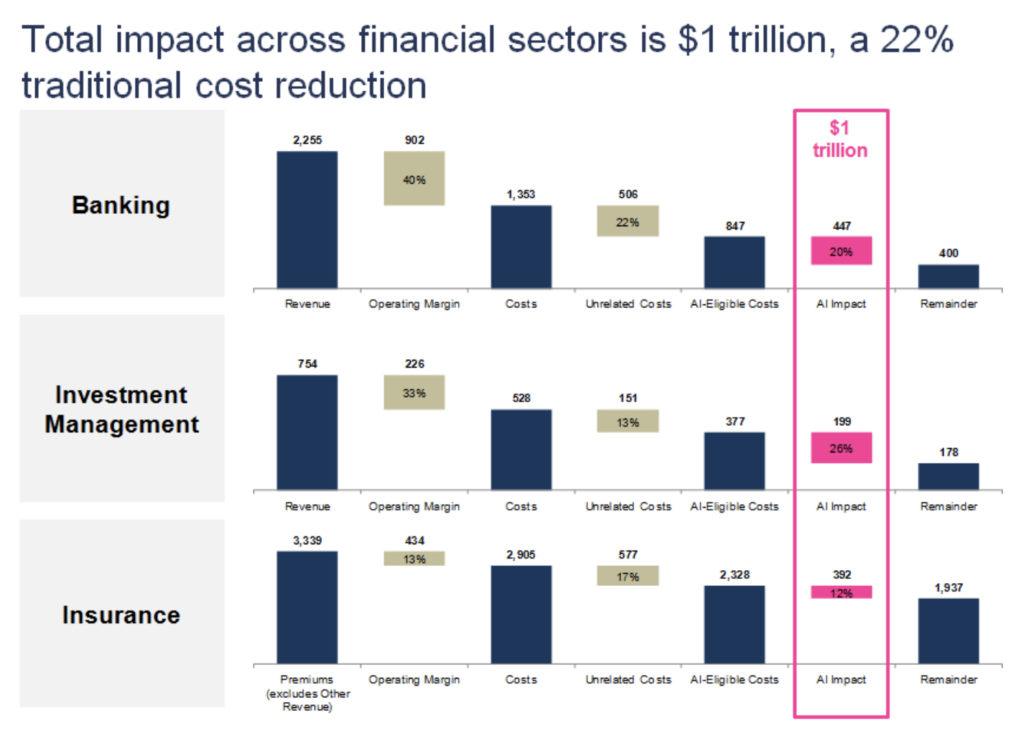

Autonomous Research Sees 22% Cost Reduction in Financial Services by 2030 through AI, Totaling $1 Trillion

Autonomous Research’s London-based NEXT unit, which focused on FinTech and…

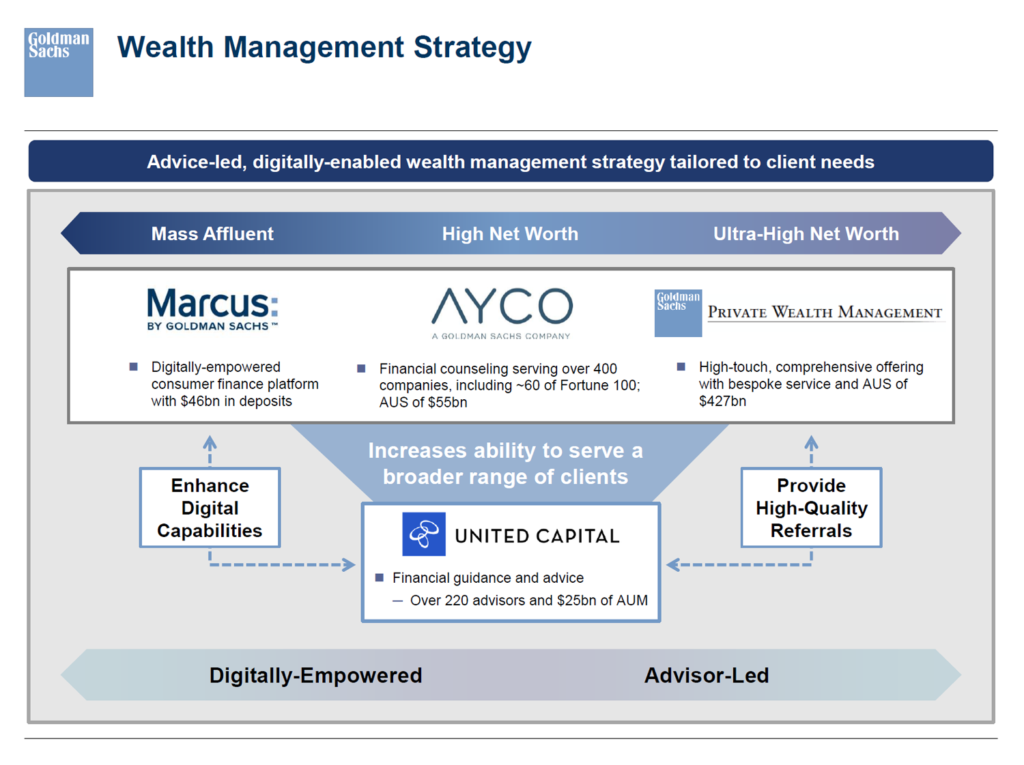

Goldman Buys RIA United Capital, Focus on Wealth Management and Digital Financial Planning

Goldman Sachs agreed to buy Newport Beach based United Capital…

About Us

We pioneered executive search 49 years ago and in 1993 the firm morphed into a liftout specialist, for investment and distribution/HNW teams. As such, our sole focus for the last two and a half decades has been on team liftouts and small acquisitions in the investment management industry.

Robert Warren pioneered the liftout business in the early nineties and Institutional Investor Magazine ten years later labeled him the “liftout king”. Daniel Enskat has written a dozen books on the asset management industry and leads our proprietary quantitative and qualitative research efforts. The combination of data and research along with our network is key to each assignment.

Moving a group of people to a new firm is NOT a liftout, a concept often misunderstood in the industry. We define a liftout as bringing you a top decile team along with an immediately marketable track record and portable institutional assets. A liftout is profitable immediately and acts a pied piper for other asset classes and products, hiring multiple individuals is not. The teams we bring are never looking in the marketplace, as they are top performers and in most cases have worked together for over a decade.

In recent years our focus has been on artificial intelligence and how it is impacting asset management distribution, operations and investments. Our team spent time all over the world to personally meet with the top AI pioneers and leaders tho see how they would tackle AI, for automation as well as investments and to get involved with asset managers, be that as a team liftout, acquisition, JV or as R&D. “AI is like teenage sex. Everyone talks about it. Nobody knows how to do it. But everyone thinks everyone else is doing it, so they claim they do it too.” This is especially true in investment management, where firms overpay for the wrong talent and address the wrong issues. We can connect you to the leaders in AI, spend less, and grow more.

"A liftout is a complex process which requires us to work with, consult and at times guide your legal, operational, compliance and HR staff to ensure a smooth process and successful business from day one."

Robert Warren

What We Do

We have facilitated over 70 team liftouts and investment boutique acquisitions in the last two decades, with each team still with the firms we placed them with. We have clients in all continents and across all business models, including long only and alternatives.

Business continuity and cultural fit are the most important factors for our work. Warren Enskat will work with you to create a systematic process and structure to find those top decile performing investment teams. We have the ability to look for multiple teams at the same time and integrate them seamlessly into the cultural fabric of the organization, along with key distribution talent, portable track records and asset trails to ensure profitability from day one along with AUM growth.